Formidable Tips About How To Find Out If Taxes Will Be Offset

Contain your name, address, and tax identification number, identify the type of debt in dispute, and;

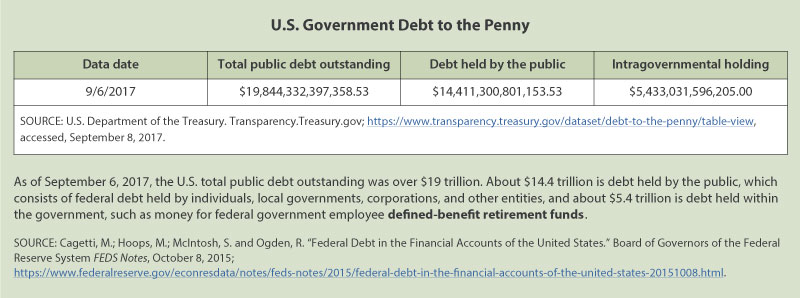

How to find out if taxes will be offset. In turn, we send new jersey income tax refunds to offset taxes owed in those states. If an individual owes money to the federal government because of a delinquent debt, the treasury department can offset that individual's federal payment or withhold the. As of this writing, the bureau of the fiscal service only maintains a hotline you can call to learn about any impending tax offsets against.

If you lived in a community property state during the tax year, the irs will divide the joint refund based upon state community property law. Know your options—speak to one of our experienced cpa / irs enrolled agents now. Ad guaranteed results from a+ bbb firm with 28 years in practice.

You can request a hearing after these deadlines, but the offset will generally. Undelivered and unclaimed federal tax refund checks. February 9, 2020 9:38 am.

If your refund is on hold for another state it can take up to 60 days for the other state to. Give a detailed statement of all the reasons that support the protest. Ad guaranteed results from a+ bbb firm with 28 years in practice.

If you are wondering whether your federal tax refund will be taken by the irs as a result of debt, owed child support, or other reasons, here is how you can find out. If your refund has been approved with the whole amount that you was supposed to receive then your all set to receive it on your ddd date. You must make a written request if you want to see the loan file and you must do this within 20 days of the notice.

Not all debts are subject to a tax refund.