Stunning Tips About How To Buy Crude Futures

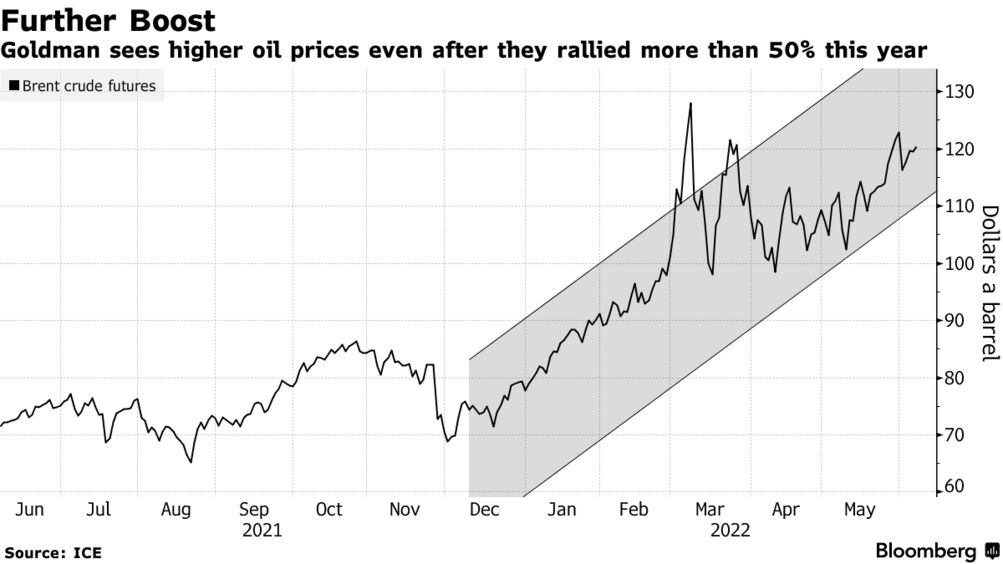

To profitably buy and sell oil futures all investors need to have a good understanding of oil fundamentals, appreciate the specifications.

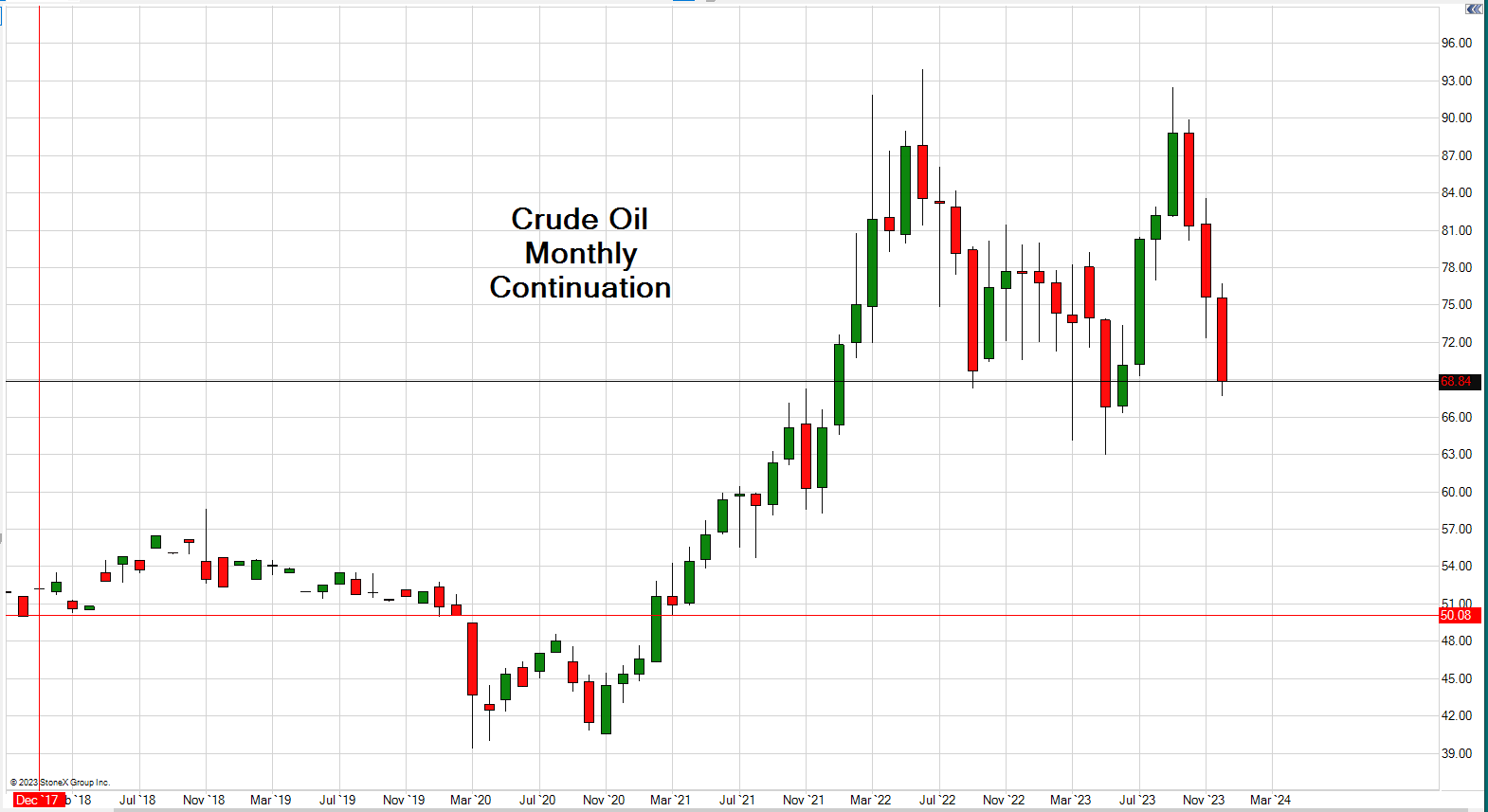

How to buy crude futures. Gain direct exposure to the crude oil market using nymex west texas intermediate (wti) crude oil futures, the world’s most liquid oil contract. Crude oil futures contract units are 1,000 barrels of crude oil. Nymex light sweet crude oil option prices are quoted in dollars and cents per barrel and their.

Open a forex account , or log in if you’re already a customer search for ‘crude oil’ in our award. You buy a stake in an oil futures contract on the new york mercantile exchange (nymex) through a broker, paying a certain price per barrel of crude oil for 1,000 barrels. More likely, you are interested in trading paper that represents large quantities of physical oil—the crude oil future.

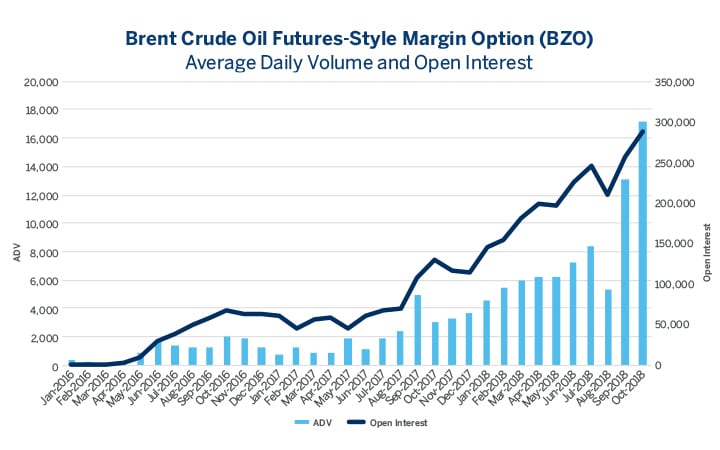

In essence, crude oil futures are financial contracts between buyers and sellers to buy and sell the specified commodity at a certain price and date. The downtick was on the back of shrinking open. Buy 1000 barrels of crude oil at usd 44.20/barrel:

When you trade a futures contract, you must either buy or sell—call or put—the commodity by the expiration date at the stated price. Just like any other futures. Wti crude oil futures are the most.

3 steps to buy and sell oil futures. If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). 12 hours agoprices of the wti navigated a volatile session on monday and closed with modest losses around the $85.00 mark per barrel.

Ad a diverse offering of futures & futures options products. Oil etfs can combine the stocks of oil. 0.01 per barrel, worth $10.00 per contract.

:max_bytes(150000):strip_icc()/dotdash_Final_5_Steps_to_Making_a_Profit_in_Crude_Oil_Trading_Aug_2020-01-58f79ee3d9fd4ee384ef25284ad48aca.jpg)